100% Foreigner Ownership

Incorporate Your Business in Labuan – Enjoy 100% Foreign Ownership and Tax Benefits!

Labuan offers the perfect environment for international businesses. Low taxes, no capital gains, and complete control.

Off-shore ,

Company Setup Services

We handle every aspect of your Labuan company formation, from registration to tax optimization and visa applications. Start operating with ease and confidence.

Business

Advantages in Labuan

We handle every aspect of your Labuan company formation, from registration to tax optimization and visa applications. Start operating with ease and confidence.

- Ownership 100%

- Tax 0%–3% Tax Rate

- Remote Incorporation Setup without visiting Labuan

- Banking Access to international banking

- Visa Business and employee visa options

- Easy Business Structure for Foreigners

Incorporate Your Business in Off-shore – Enjoy 100% Foreign Ownership and Tax Benefits!

Incorporate Your Business in Labuan – Enjoy 100% Foreign Ownership

Labuan, Malaysia’s federal territory, offers business owners exceptional tax advantages, easy company setup, and no local partner requirements. Whether you’re in fintech, eCommerce, or consulting, Labuan offers unmatched benefits.

100% Foreign Ownership

100% Foreign Ownership

Low Tax Rates (0%-3%)

Low Tax Rates (0%-3%)

No Withholding Tax

No Withholding Tax

Easy Business Structure for Foreigners

Easy Business Structure for Foreigners

Business Advantages in Labuan

Empire Corporate Consultants SDN.Bhd

Our Other Services

With over 10 years of experience in corporate management and business consulting, we have played a key role in the growth of multiple businesses in Malaysia and Overseas. Our expertise covers different industries, from corporate strategy to educational consultation and MM2H.

Off-Shore Labuan

Company advisory

Labuan company registration refers to the procedure of establishing a business entity in Labuan, which is recognized as Malaysia’s offshore financial center and operates under the Labuan

On-Shore Company

Sdn Bhd company Advisory

An onshore company in Malaysia is a business entity that is incorporated and operates within the country’s borders, subject to its local laws, regulations

MM2H

Advisory

The Malaysia My Second Home (MM2H) Programme offers more than just residency — it opens the door to a lifestyle enriched by peace, cultural diversity, economic opportunity, and natural beauty.

Video Section

Our Videos

Empire Coperate Consultanat

Deep understanding of Malaysia’s corporate laws, including the Companies Act 2025. Our AI-enhanced systems ensure your company stays fully compliant with all statutory requirements, filing annual returns, and maintaining statutory registers.

Scope of Services

Contact Us

Let's get in touch

Message

Our Contact

Email Address

info@empirecorporatemy.com

Call Us

+6o1162448854

Social Media

Location

Malaysia

TAMAN SERDANG PERDANA , SEKSYEN 6, 433OO SERI KEMBANGAN SELANGOR

FAQ

Off-Shore company

An offshore company in Malaysia, officially known as a Labuan International Company, is a business entity incorporated in the federal territory of Labuan. 🏝️ This type of company is designed for international business activities and is distinct from companies registered in mainland Malaysia. It operates under specific legislation, such as the Labuan Companies Act 1990, and is regulated by the Labuan Financial Services Authority (LFSA).

Offshore companies in Malaysia are primarily established in the federal territory of Labuan. They’re often used by international businesses for their attractive tax benefits and business-friendly regulations.

1. What is an offshore company in Malaysia?

An offshore company in Malaysia, officially known as a Labuan International Company, is a business entity incorporated in the federal territory of Labuan. 🏝️ This type of company is designed for international business activities and is distinct from companies registered in mainland Malaysia. It operates under specific legislation, such as the Labuan Companies Act 1990, and is regulated by the Labuan Financial Services Authority (LFSA).

2. What are the key benefits of a Labuan offshore company?

Labuan offshore companies offer several key advantages that make them a popular choice for foreign investors:

Tax Incentives: Trading companies can opt for a low corporate tax rate of 3% on audited net profits, while non-trading or investment holding companies can be completely tax-exempt. 💰 They are also generally exempt from other taxes like sales and service tax (SST), stamp duty, and withholding tax on dividends and royalties.

100% Foreign Ownership: Foreigners can own 100% of the company without needing a local partner.

Confidentiality: The names of directors and shareholders are not publicly disclosed, providing a higher level of privacy.

Flexible Visa Options: Establishing a Labuan company can make you and your family eligible for a renewable, two-year business visa.

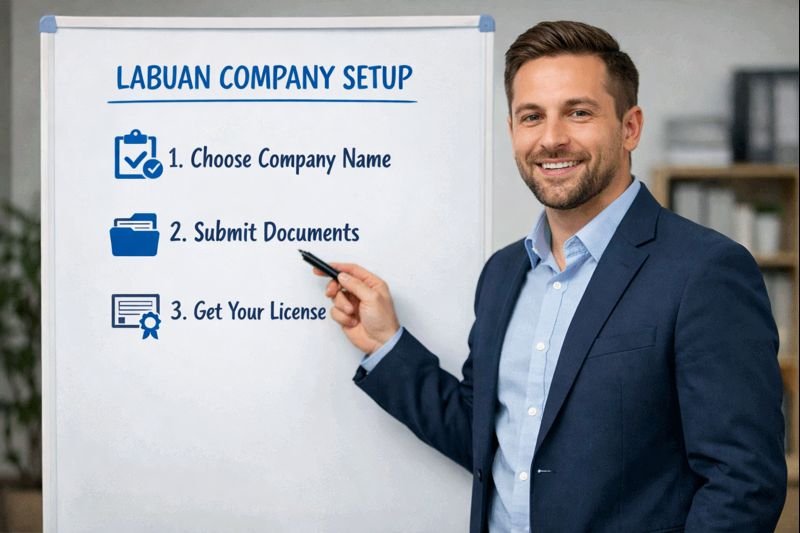

Simple Requirements: The incorporation process is straightforward, requiring a minimum of just one director and one shareholder, who can be the same person and of any nationality. There’s also no minimum paid-up capital requirement, though at least one share must be issued.

To set up a Labuan offshore company, you must fulfill several legal requirements:

Registered Office: You must have a registered office in Labuan.

Resident Secretary: It is mandatory to appoint a resident company secretary who is an officer of a Labuan trust company. This trust company also provides the registered office and handles other secretarial duties.

Director and Shareholder: A minimum of one director and one shareholder is required. These individuals can be the same person, of any nationality, and can be corporate entities.

Economic Substance: To qualify for the preferential tax treatment, the company must meet specific “economic substance” requirements. This includes having a prescribed number of full-time employees in Labuan and incurring a minimum annual operating expenditure there, with the exact figures depending on the business activity.

A Labuan offshore company can engage in a wide range of legal international business activities. These include:

Trading activities: This covers a broad spectrum of businesses, such as international import and export, e-commerce, and consultancy services.

Non-trading activities: This primarily involves investment holding, where the company holds shares, securities, or real estate.

Financial services: With the appropriate licensing, the company can conduct banking, insurance, fund management, and leasing operations.

On-Shore Company

An on-shore company, also known as a domestic company, is a business entity incorporated on the Malaysian mainland and is subject to the country’s main legal and tax frameworks. These companies are registered with the Companies Commission of Malaysia (SSM) under the Companies Act 2016. The most common type of on-shore company is a Private Limited Company (Sdn Bhd), which is a separate legal entity from its owners, offering limited liability to its shareholders.

There are several types of on-shore business entities you can establish in Malaysia, each with its own characteristics and legal implications:

Sole Proprietorship: Owned and run by a single individual, with no legal distinction between the owner and the business. The owner is personally liable for all business debts.

Partnership: A business owned by two or more individuals (up to 20) who agree to share profits and losses. Partners are personally liable for the business’s debts.

Private Limited Company (Sdn Bhd): The most popular choice for both local and foreign investors. It’s a separate legal entity, meaning the liability of its shareholders is limited to their share capital.

Public Limited Company (Berhad): A company whose shares are offered to the public and can be traded on the Malaysian stock exchange. It’s suitable for large businesses seeking to raise capital from the public.

Limited Liability Partnership (LLP): A hybrid of a partnership and a company, offering the flexibility of a partnership with the limited liability of a company.

The requirements for setting up an on-shore company, particularly a Sdn Bhd, include:

Company Name: The proposed name must be approved by the Companies Commission of Malaysia (SSM).

Directors: A minimum of one director is required. The director must be at least 18 years old, a resident of Malaysia, and not disqualified from acting as a director.

Shareholders: A minimum of one shareholder is needed. Shareholders can be individuals or corporate entities, and there are no restrictions on foreign ownership.

Company Secretary: It is a legal requirement to appoint at least one company secretary, who must be a member of a professional body approved by the Minister of Domestic Trade and Consumer Affairs.

Registered Office: The company must have a registered office in Malaysia to which all official communication can be sent.

Share Capital: There is no minimum share capital requirement, but companies typically have at least one share with a value of RM1.

Setting up an on-shore company in Malaysia provides several benefits for businesses, especially those focused on the local market:

Local Market Access: On-shore companies have full access to the Malaysian domestic market and can transact freely in Malaysian Ringgit.

Credibility: Operating as a legally registered entity in Malaysia can build credibility and trust with local partners, customers, and government bodies.

Government Support: On-shore companies are often eligible for various government grants, incentives, and support programs aimed at promoting local businesses.

Established Infrastructure: The country provides a stable and well-regulated business environment with developed financial, legal, and logistical infrastructure.